State Credit Union Board Compensation

By Mary A. Rizzuti and Daniel Markham

Credit unions provide financial services to a total membership of over 140 million Americans¹. Their position as financial institutions forces their labor market to straddle both the nonprofit sector and the for-profit banking sector. This means credit unions must attract and retain high-caliber talent while fulfilling their mission of providing low-cost financial services.

Understanding State Credit Union Board Compensation

The executive officers of credit unions often receive incentive compensation similar to their banking peers (except without the use of equity). However, when it comes to the compensation of the boards of directors, credit unions break with the for-profit banking sector for several reasons, including:

- Federal legislation limits federally chartered credit unions to compensating only one board member.

- State legislation limits state-chartered credit unions to compensating board members in 22 states.

- Increased liability protections that uncompensated board members receive.

Despite these limitations, the number of states permitting compensation for state-chartered credit unions has steadily increased for several reasons, including:

- The necessity for specialized knowledge and extensive experience to effectively govern a large financial institution.

- The workload and necessity for board members to pay attention and maintain vigilance.

- Competition with for-profit banks for fully qualified board members.

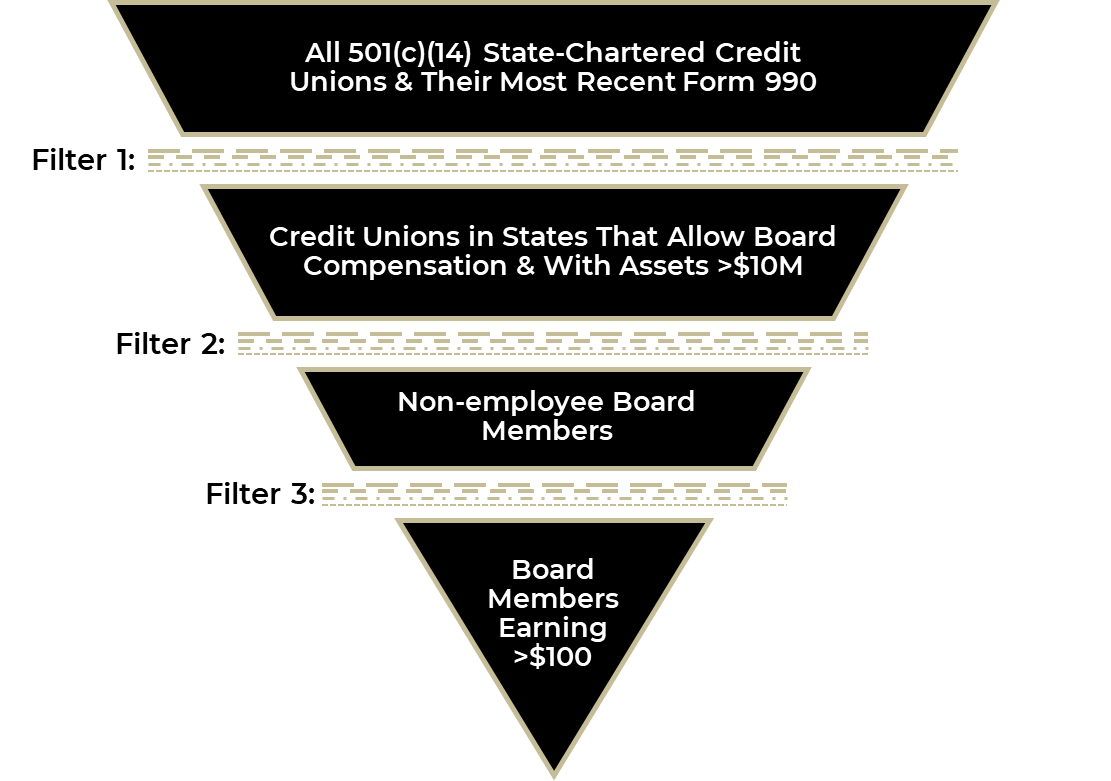

To help facilitate discussions on credit union board compensation, Compensation Resources conducted an analysis of nonprofit board compensation using publicly available information reported in IRS Form 990s filed in 2024 by 501(c)(14) state-chartered credit unions.

Methodology

Below is an overview of our data collection process illustrating which organizations were analyzed:

In addition to the information in the IRS Form 990s, Compensation Resources also conducted a comprehensive review of credit union board compensation laws in all 50 states and reviewed financial metrics published by the National Credit Union Administration’s quarterly call reports to provide more in-depth context for each organization.

Results

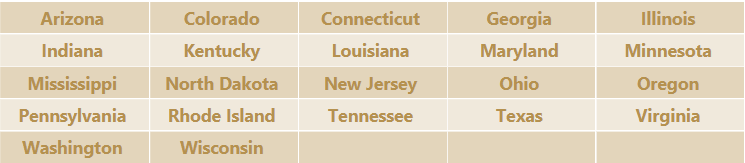

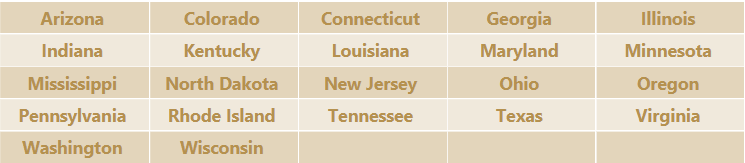

The following states allow for board compensation:

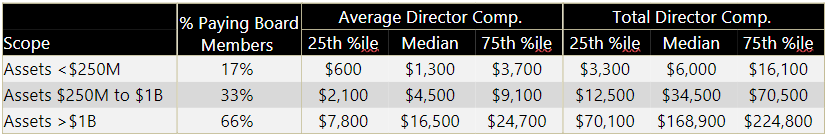

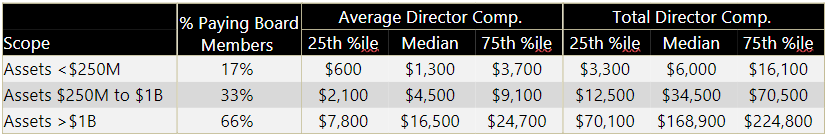

The range of compensation across all credit unions is quite large since they represent a group of credit unions spanning an asset size of $10 million to over $10 billion. However, breaking down the data by asset size reveals important trends.

Smaller credit unions (under $250 million in assets) appear to compensate their board members modestly. However, for over half of the large credit unions, total board compensation spend was in the six-figure range.

The Future of State Credit Union Board Compensation

As the financial landscape continues to evolve, the compensation of state credit union boards remains a critical issue. While regulatory constraints present ongoing challenges, the trend toward allowing board compensation in more states reflects a growing recognition of the importance of attracting and retaining skilled board members.

¹Represents total credit union membership per the National Credit Union Administrations.